原文标题:BanksThe prize of sizeWhy America will soon see a wave of bank mergers银行 规模的好处为什么美国很快就会出现银行合并浪潮?Cheap valuations and a stricter rulebook point towards more consolidation廉价的估值和更严格的规则导致更多银行的合并

[Paragraph 1]THE TROUBLE facing many of America’s banks is coming into sharp relief. 美国许多银行面临的问题引人注目。After the failures of Silicon Valley Bank (SVB) and Signature Bank in March, behemoths such as JPMorgan Chase and Bank of America attracted deposits despite paying minimal interest, according to earnings reports released since April 14th. 在 3 月份硅谷银行和签字银行倒闭后,根据 4 月 14 日以来发布的财报,尽管摩根大通和美国银行等巨头支付的利息很低,但仍吸引了存款。Many small and medium-sized banks, by contrast, face increasing competition for customers and rising funding costs. 相比之下,许多中小型银行面临着日益激烈的客户竞争和不断上升的融资成本。

On April 18th Western Alliance, a lender with $71bn of assets, reported that it had lost 11% of its deposits this year. 4 月 18 日,拥有 710 亿美元资产的阿莱恩斯西部银行报告称,今年它的存款减少了11%。To tempt deposits back, banks will have to pay more for them; in the meantime many have turned to temporary loans, including from the Federal Reserve, that incur today’s high rates of interest. 为了吸引存款回来,银行将不得不付出更多的成本;与此同时,许多银行已经转向临时贷款,包括从美联储贷款,这些贷款导致了今天的高利率。Yet lots of banks’ assets are low-yielding and cannot be sold without crystallising losses. A big profits squeeze is coming.

然而,许多银行的资产收益较低,无法在不产生损失的情况下出售。一场巨大的利润挤压即将到来。

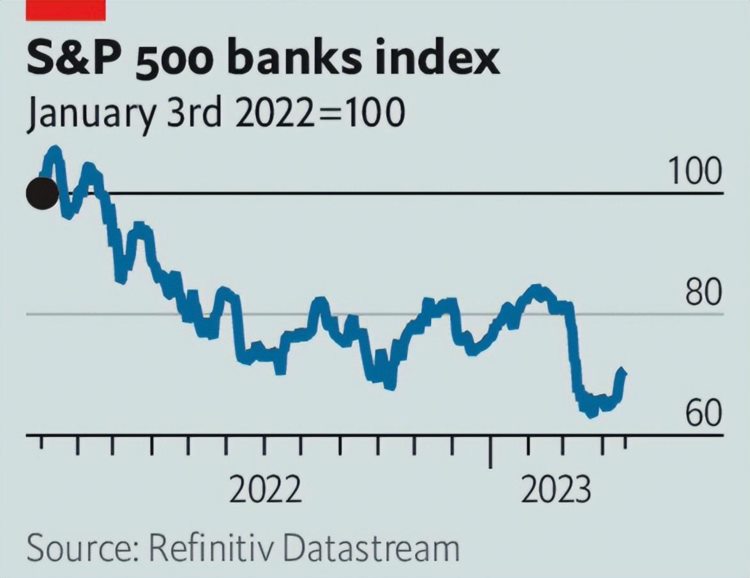

[Paragraph 2]More banks were due to report earnings after we published this leader. 我们发布本篇社论文章后,有更多的银行将公布收益。But the market has already made a judgment: America’s banks are worth only about their combined book value, having traded at nearly a 40% premium at the start of the year. 但市场已经做出判断:美国的银行只值他们的总账面价值,年初时的交易溢价近 40%。The likely result of their low valuations, combined with a landscape in which size matters, is a tried-and-tested response to banking crises over the past four decades: consolidation.它们的低估值,加上规模的重要性,可能导致对过去40年来银行业危机久经考验的反应:整合。

[Paragraph 3]America has 4,700 banks and savings institutions, or one for every 71,000 residents. 美国有 4,700 家银行和储蓄机构,即每7.1万居民就有一家银行。To observers in the EU, which has only one bank for every 85,000 people, that seems excessive. 对于每 8.5万居民才有一家银行的欧盟观察家来说,美国的银行似乎过多了。Yet it is a historical low: in 1984, when comparable data begin and the population was much smaller, there were nearly four times as many institutions. 然而,这是一个历史最低点:1984 年,那年可比数据开始出现且人口少得多时,银行的数量几乎是现在的4倍。Since then the industry has seen almost continuous consolidation. 从那时起,该行业几乎一直在整合。

The biggest wave of mergers came after a long-running crisis among savings and loan associations (S&Ls), lenders specialising in mortgages, reached its apex in the late 1980s. 最大的合并浪潮发生在储蓄和贷款协会 (S&L) 的长期危机之后,这些专门从事抵押贷款的贷方在 1980 年代末达到顶峰。It left many carcasses over which stronger banks could pick. 顶峰之后是哀鸿遍野,实力更强的银行可以从中挑选合并。Rule changes, such as the lifting of restrictions on banking across state lines, also encouraged banks to grow in size.规则也发生变化,例如取消对跨州银行业务的限制,也鼓励银行扩大规模。

[Paragraph 4]There are several parallels between then and now. 那时和现在有几个相似之处。Many S&Ls went bust because their funding costs rose as interest rates surged, while their mortgage-loan books brought in low, fixed rates of interest. 许多抵押贷款机构破产,因为他们的资金成本随着利率的飙升而上升,而它们的抵押贷款合同只带来了较低的固定利率。At one point nearly two-thirds of S&Ls would have been insolvent had their assets been marked to market. 曾几何时,如果抵押贷款机构的资产按市价计价,将近2/3的机构会资不抵债。

Although the balance-sheet problems of today’s banks are less severe, they are similar in nature. 尽管现今银行的资产负债表问题没有那么严重,但它们在本质上是相似的。At the end of 2022 more than 400 banks with nearly $4trn in combined assets had unrealised losses on their securities portfolios worth at least half of their core equity capital. 在2022年底,400多家拥有近4万亿美元总资产的银行,其证券组合的未实现损失至少占其核心股本的一半。

Include their fixed-rate loan books, and possible losses to come on lending against commercial property, and the hole would be greater still.包括他们的固定利率贷款账目,以及商业地产贷款可能带来的损失,这个漏洞会更大。[Paragraph 5]At the same time, smaller banks are at risk of losing the regulatory advantages they now enjoy. 与此同时,小型银行有可能会失去它们现有的监管优势。

When calculating their regulatory capital, banks with less than $700bn in assets typically do not have to mark to market even the securities that they class as “available for sale” and which are meant to be a source of quick cash in an emergency. 在计算其监管资本时,资产少于 7000 亿美元的银行通常不必将 "可供出售 "的证券计入市场,这些证券存在的意义是在紧急情况下能成为快速现金来源。Those smaller than $250bn are exempted from the strictest liquidity rules, stress tests and failure planning. 那些规模小于 2500 亿美元的银行不受最严格的流动性规则、压力测试和破产计划的约束。This light-touch regulatory regime is now being reviewed by domestic and international regulators. 这种宽松的监管制度目前正在接受国内和国际监管机构的审查。

The Basel Committee on Banking Supervision, which writes the global rulebook, is studying the lessons to be learned from the failure of SVB, whose depositors were bailed out even though it was too small and domestically focused to be subject to the strictest rules. 编写全球规则手册的巴塞尔银行监管委员会正在研究硅谷银行破产的教训,尽管硅谷银行的规模太小,而且主要集中在美国国内,不受最严格规则的约束,但它的储户得到了救助。In Washington, an easing of the rules for midsized banks by Congress and the Fed in 2018 and 2019 is under fresh scrutiny.在华盛顿,国会和美联储在 2018 年和 2019 年对中型银行的宽松规定,正受到新的审查。

[Paragraph 6]The most important changes to the market’s structure are likely to be among banks which are close to significant regulatory thresholds. 市场结构最重要的变化可能是在那些接近重要监管门槛的银行中。

There are 20 banks which are between $100bn and $250bn in size. If the penalty for crossing the $250bn threshold is reduced, many may find it advantageous to merge. 有 20 家银行的规模在 1000 亿美元到 2500 亿美元之间。如果超过 2500 亿美元门槛的罚款减少,许多银行可能会发现合并是有利的。

Doing so would allow them to spread the growing costs of complying with regulation over a bigger business, while making it even more likely that their depositors would be bailed out in a crisis. 银行合并将使他们能够将因遵守监管而增加的成本分摊到更大的业务上,同时使他们的储户更有可能在危机中获得救助。

Regulators would probably look favourably on tie-ups that swallowed up zombie banks which might otherwise “gamble for resurrection” by taking big risks—a tactic that made the S&L crisis in the 1980s much worse. 监管机构可能会乐意看到那些吞并僵尸银行的合作,否则僵尸银行可能会通过冒大风险“为活命搏一搏”——这种策略使 1980 年代的储贷危机危机更加严重。If so, then the latest crisis will provide the latest impetus for banks to get bigger. 如果是这样,那么最近的危机将为银行做大提供最新的动力。

(恭喜读完,本篇英语词汇量765左右)原文出自:2023年4月22日《The Economist》Leaders版块

精读笔记来源于:自由英语之路

本文翻译整理: Irene

本文编辑校对: Irene仅供个人英语学习交流使用。

【补充资料】(来自于网络)储蓄贷款协会(Savings and loan associations)是一种金融机构,专门接受客户存款并用这些资金提供抵押贷款给购房者。S&Ls通常在储蓄账户上提供较高的利率,并在抵押贷款上提供较低的利率,相比商业银行更具吸引力。它们最初是以互助组织的形式注册的,意味着储户也是S&L的成员,拥有所有权利。然而,许多S&Ls已经转变为股份制结构。该行业多年来经历了重大的变革和整合,但S&Ls仍继续在为个人和社区提供住房金融服务扮演着重要角色。

未实现损失Unrealised losses是指投资组合中某些资产的市场价值下跌,但这些资产尚未被出售或清算时所产生的损失。在某些情况下,可能会在未来重新升值并抵消这些损失。这与已实现损失(Realized losses)不同,已实现损失是指资产已经被出售或清算,且以低于购买价格的价格进行了交易,从而导致了明确的损失。

巴塞尔银行监管委员会(Basel Committee on Banking Supervision)是由全球各国银行监管机构组成的一个国际组织,总部设在瑞士巴塞尔。其目的是制定银行业监管政策和标准,以确保全球金融体系的稳定性和安全性。该委员会的主要任务之一是推动并制定《巴塞尔协议》(Basel Accords),这些协议规定了银行的资本充足率要求和风险管理标准等内容,成为全球银行监管的基础。

【重点句子】(3个)Many small and medium-sized banks, by contrast, face increasing competition for customers and rising funding costs. 相比之下,许多中小型银行面临着日益激烈的客户竞争和不断上升的融资成本。At the same time, smaller banks are at risk of losing the regulatory advantages they now enjoy. 与此同时,小型银行有可能会失去它们现有的监管优势。Doing so would allow them to spread the growing costs of complying with regulation over a bigger business, while making it even more likely that their depositors would be bailed out in a crisis. 银行合并将使他们能够将因遵守监管而增加的成本分摊到更大的业务上,同时使他们的储户更有可能在危机中获得救助。

自由英语之路